Some insurance firms do not submit SR-22s. If this holds true with your provider, you may need to locate one more one that does. Also after finding a service provider that will submit an SR-22 in your place, your prices will certainly probably be greater than when you had a clean driving record.

Non-owner insurance policy is best for those who require evidence of insurance policy also if they don't drive routinely as well as those who usually drive automobiles they don't own, such as individuals that rent cars and trucks or borrow them from loved ones. The typical expense of non-owner cars and truck insurance policy in Ohio for SR-22 filers is $501 annually, yet costs vary by company.

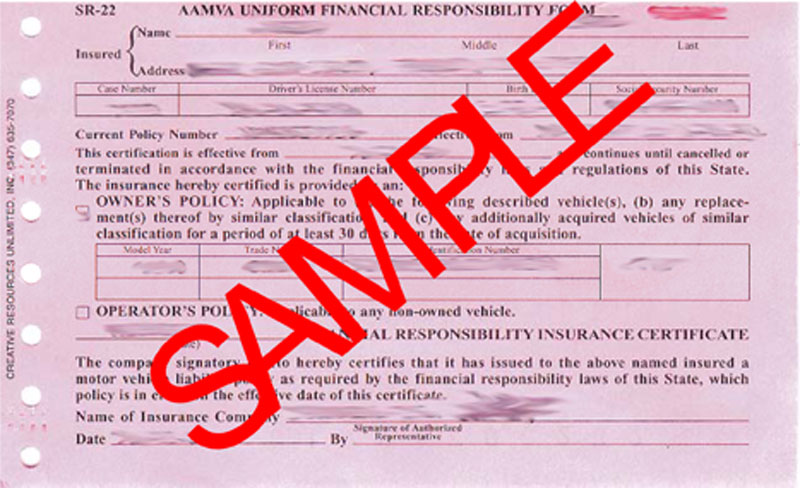

A few of these may include: broaden ALLWhat is an SR-22 in Ohio? SR-22 describes a type filed by your insurance company to prove that your protection satisfies the state's minimal vehicle insurance coverage liability protection. Where can Ohio vehicle drivers get an SR-22? Ohio vehicle drivers can get an SR-22 by calling their car insurance coverage suppliers and paying an one-time fee of about $25.

Which company in Ohio is most affordable for SR-22 insurance? USAA offers the most affordable SR-22 insurance policy in the state at $357 per year, although its membership is limited to armed forces persons and their households. State Farm is the most inexpensive provider for the general public, setting you back an average of $379 per year.

Facts About What Is Sr-22 Insurance? - Autobytel.com Uncovered

Rates are for the same chauffeur with both a tidy document and a DUI.About the Writer, Ohio Bureau of Electric Motor Vehicles (auto insurance). "SR-22/ Bond - liability insurance." Accessed January 19, 2021.

Ohio motorists that have actually had their licenses suspended, either because of significant moving infractions or driving without insurance, may be called for to submit an SR-22 to reinstate their driving privileges. sr-22 insurance. SR-22 kinds can just be filed with the Ohio BMV by an insurer, and also you'll first require to buy either auto insurance coverage or a financial duty bond that satisfies the state's requirements (division of motor vehicles).

Cost of SR-22 insurance coverage in Ohio The cost of an SR-22 filing in Ohio is fairly reduced; insurance firms commonly bill an one-time charge around $20 to submit the document with the BMV - ignition interlock. SR-22 insurance quotes, nevertheless, will certainly often be a lot greater than quotes for a conventional plan due to whatever incident caused you to need the SR-22 declaring.

While you can meet an SR-22 requirement with an FR bond in Ohio (the least expensive choice), this insurance coverage isn't created for car proprietors, and also we suggest you think about insurance policy alternatives. The FR bond is limiting given that you are restricted to just the state's legitimately needed insurance coverage, and also there's no first-party insurance coverage.

A Biased View of What Is Sr-22 Insurance - Nextadvisor With Time

What is an SR-22 in Ohio? In Ohio, you may be called for to file an SR-22, or certificate of financial obligation, in order to reinstate your driving opportunities if they have actually been suspended for some factor (department of motor vehicles). This can happen if the state has identified you to be a, such as after a DUI or numerous moving infractions, or if you have actually been caught driving without evidence of financial duty (liability insurance).

Depending on the factor your certificate was suspended, Ohio may need you to submit an SR-22 for either 3 or five years. Your insurance company is called for to inform the BMV if you have a gap in insurance policy coverage throughout this period, in which instance you will certainly shed your driving advantages once more (coverage).

Or else, you'll need to redeem coverage as well as pay a reinstatement cost to the Ohio BMV to be able to continue driving. underinsured. Why would certainly I need to submit an SR-22 in Ohio? High-risk motorists that have been, careless driving or have actually or else accumulated at the very least 12 factors on their driving records in the past 2 years might have their licenses suspended and also be required to submit SR-22s in Ohio - driver's license.

An additional common reason Ohio vehicle drivers may require to submit an SR-22 is that they have actually been caught driving without insurance policy. Ohio's financial duty law requires all chauffeurs to lug either automobile insurance coverage or one more form showing economic responsibility if entailed in an accident - sr22 insurance. The intent of this regulation is to make sure that if you're at mistake in a crash, you'll be able to spend for any resulting injuries as well as home damage.

Little Known Questions About What Is Sr22 Insurance? - The Balance.

The only distinction is that your insurance company will likewise file an SR-22 kind with the Ohio BMV revealing proof that your policy remains in place. The type is submitted digitally as well as is generally refined within three days, at which time you should be notified and able to drive lawfully again, once you've taken any kind of various other required actions (sr22).

Given that an SR-22 bond just provides obligation insurance policy, any type of injuries to you or problems to the lorry you were driving would not be covered if you were at mistake in an accident. credit score.

HOW MUCH TIME IS AN SR-22 VALID? Each state has its own needs for the length of time that an SR-22 need to remain in location. As long as you pay the necessary costs and also to keep your plan active, the SR-22 will remain in result up until the requirements for your state have been met.

insurance companies ignition interlock sr-22 insurance sr22 coverage underinsured

insurance companies ignition interlock sr-22 insurance sr22 coverage underinsured

WHAT IS THE DIFFERENCE IN BETWEEN AN SR-22 AND AN FR-44? In the states of Florida as well as Virginia, an FR-44 is a "Certification of Financial Responsibility". It resembles an SR-22, yet an FR-44 normally calls for greater liability limitations. division of motor vehicles. ARE THERE ANY COSTS FOR DECLARING AN SR-22? A lot of states need a tiny declaring fee when an SR-22 is very first filed.

Rumored Buzz on Sr-22 Insurance: Compare Quotes And Find Cheap Coverage

At Safe, Automobile, we recognize that buying for automobile insurance policy coverage can be stressful and costly. You can call a devoted Safe, Car customer support agent at 1-800-SAFEAUTO (1-800-723-3288) to request an SR-22 be filed.

If you're considered a risky driver such as one who's been convicted of multiple traffic offenses or has received a DUI you'll probably have to come to be accustomed to an SR-22. What is an SR-22? An SR-22 is a certification of financial duty required for some vehicle drivers by their state or court order (deductibles).

Depending upon your situation and what state you stay in, an FR-44 might replace the SR-22 (sr-22 insurance). How does an SR-22 work? You must have a quite clear concept of when you'll require an SR-22. Typically, you'll get a court order needing that you get one as an outcome of a driving infraction.

1 It depends on your vehicle insurance business to file an SR-22 type for you. You may be able to include this onto a current policy, yet remember that not every vehicle insurance provider agrees to offer SR-22 insurance (no-fault insurance). In this situation, you'll need to go shopping for a new policy.

The 4-Minute Rule for Sr-22 (Insurance) - Wikipedia

auto insurance coverage ignition interlock dui driver's license

auto insurance coverage ignition interlock dui driver's license

In addition, submitting an SR-22 is a key action in attaining a hardship or probationary certificate. 3 Exactly how long will you require to have it? In the majority of states, an SR-22 is needed for 3 years, but you ought to contact your Great site state's DMV to learn the specifically how much time you'll require it.

You might even have to start the SR-22 process all over once again. Attempt to comprehend any type of various other criteria that control your SR-22.

3 The filing procedures for the SR-22 as well as FR-44 are similar in lots of ways. Several of the major points they share include4,5,6: FR-44s are usually called for through court order, or you can verify your need for one by calling your regional DMV. Your vehicle insurer will certainly submit your FR-44 in your place with the state's automobile authority.

credit score sr22 coverage driver's license ignition interlock car insurance

credit score sr22 coverage driver's license ignition interlock car insurance

For context, the minimal liability coverage for a normal chauffeur is just $10,000 for bodily injury or death of someone. 7 Where to obtain an SR-22 If you believe you need an SR-22, contact an insurance coverage agent. They'll be able to lead you through the whole SR-22 declaring procedure and also ensure you're meeting your state's insurance coverage regulations. deductibles